Sinpe Móvil is a Mobile Payment System that was developed as a service that is targeted at the retail payment sector for smaller sums. Users of the National Financial System may now send money electronically to mobile phone-linked bank accounts using any online banking platform. It’s built to provide clients with a reliable payment system that can be used anywhere, with any device, and that offers high availability and wide coverage.

Besides, Sinpe Móvil may also be understood as an electronic payment system created in 2015 by the Central Bank of Costa Rica (BCCR) and distinguished by its safety, simplicity, availability, widespread coverage, and cheap transaction fees. The organization won the 2015 Innovation Award from the Latin American Federation of Banks (Felaban) for introducing this payment system.

Sinpe Móvil Features

You may use this service whenever, anywhere, and for as much money as you want, up to a daily limit of ₡ 100,000 colones, and you won’t have to pay any fees or commissions to do it. All you need is the recipient’s phone number.

At the receptionist level, the monthly cap is also ₡ 2,000,000 colones. Furthermore, linking your mobile phone number to a certain bank account in colones is a simple operation. Multiple phone numbers may be associated with the same account.

However, you may only associate the same number with one of your accounts if you have several bank accounts at a variety of banks. In the same manner, it will only function for the shipping of relatively small quantities of money, and that money must be in colones. Depending on the bank, you may be able to link your phone number to your account via mobile banking, online banking, visiting a branch, or calling customer service.

Types of Transactions with Sinpe Móvil

1. Balance Inquiry

Using the mobile phone number, you may check the balance of the associated account.

2. Mobile Payment

A customer may use their mobile phone number associated with the service to send money to anybody with an account, whether that person’s account is held at the same commercial bank as the customer’s or at a different institution that also provides Mobile Payment.

3. Affiliation

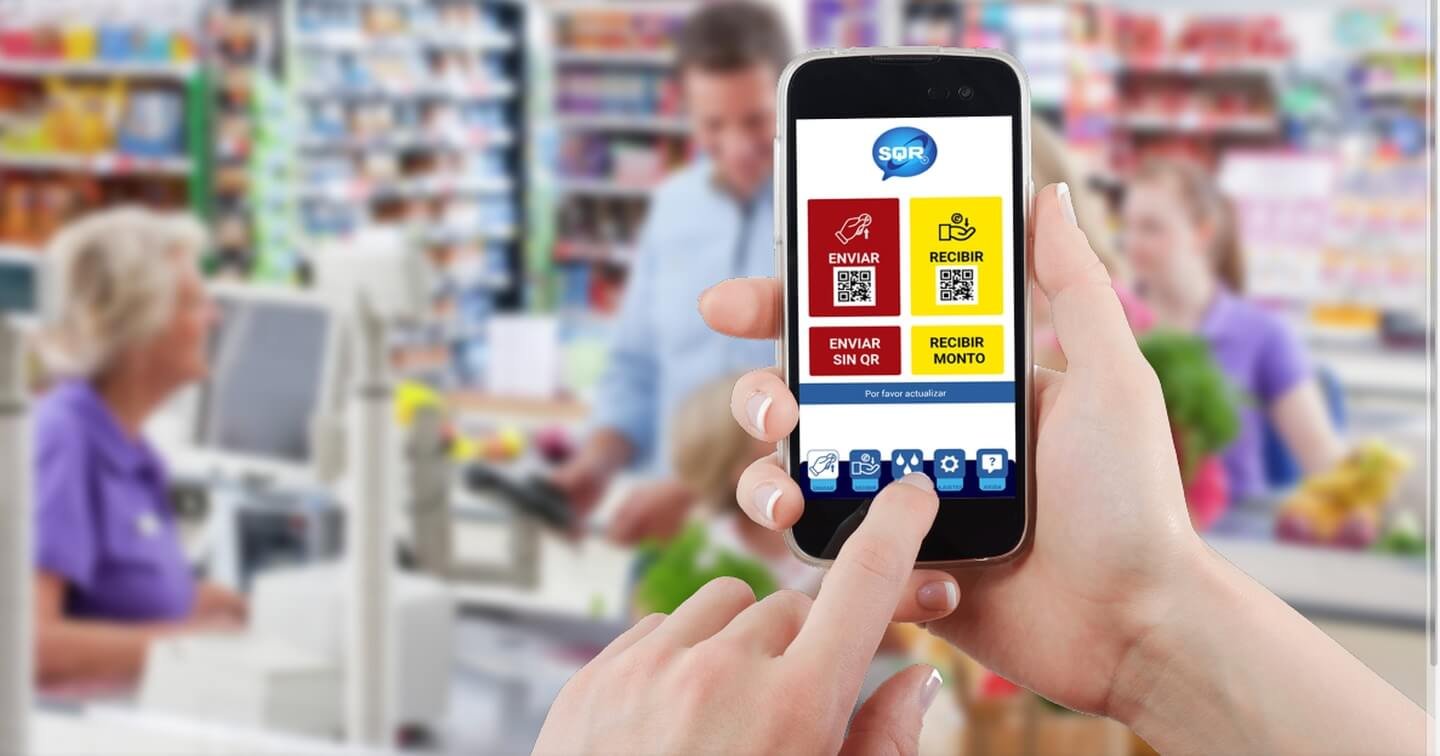

Affiliation makes it easy for Sinpe Móvil customers to access this feature on their mobile devices.

4. Transaction Inquiries

Inquiring about transactions reveals the most recent balance adjustments made to the account associated with the mobile phone number.

5. Cancellation

Sinpe Móvil’s mobile app has a cancellation feature that may be used to cancel access to the service.

Purpose of Sinpe Móvil?

Through Sinpe Móvil, the National Financial System is able to provide its consumers with a mass-market mobile payment system, which should help to lessen the economy’s reliance on cash.

How to Use Sinpe Móvil?

A Sinpe Móvil may be activated by presenting your phone number to a bank, which can be done either in person or online if you already have a Sinpe Móvil. Setting up an account with several banks is not possible. In other words, if you have many bank accounts, you can only link one Sinpe Móvil account to your mobile device. There is no time limit on making a change. Sinpe Móvil only accepts payments in colones, thus you’ll need a colones account to use the service.

You may make a payment by opening the app associated with your bank, entering the recipient’s phone number, and the amount, and then tapping the “send” button. If you choose, you may also use your bank’s online services to complete the transaction. If you need to send money to an account at another bank, remember to use Sinpe Móvil rather than Sinpe, since Sinpe charges a fee for such transfers.

Once you’ve activated your Sinpe Móvil number at the bank, all you need to do to accept payments is provide the individual paying you your phone number. Sometimes a bank may send you a text message, but often they’ll use instant messaging.

Latest Updates about Sinpe Móvil

There has been a commotion in recent weeks about the prospect that users may have to pay more for Sinpe Móvil transfers since the Ministry of Finance (Ministerio de Hacienda) has proposed charging for Sinpe Móvil transactions. They did it to strengthen the collection of Value Added Tax (VAT) from individuals who use Sinpe as a payment method, i.e., on the purchases of products and services.

However, the tax authorities specify that no VAT or other tax will be collected on transfers of funds between personal accounts, transfers made on behalf of relatives or friends, or Transfers made when there is no underlying transaction for the purchase and sale of goods or services.

Requirements for using Sinpe Móvil?

For this service to be available, the consumer must have access to colones via an active account at one of the participating financial entities. He has to have a working mobile phone and meet any additional criteria his bank or other financial institution sets.